Category: General Thinking

-

AI

What we call AI today is going to commonplace tomorrow and considered rather rudimentary. When will human intelligence get the same amount of hype that AI gets?

-

How much can you handle?

Every hardship teaches you how much you can handle.

-

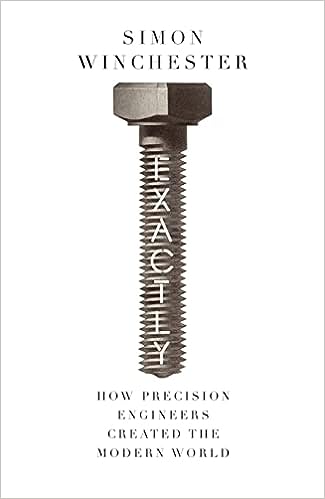

Exactly

A book by Simon Winchester. On the precision manufacture of products and machines.

-

AI as a Rorschach Test

Is AI really going to destroy the world? How?

-

Silent as a Ghost

What would cause someone to christen a car – Ghost?

-

Language of Marketing

I have been contributing some of my writing to a project called the Carbon Almanac which was conceived by Seth Godin. Gave me an opportunity to quiz him on things. He has written a total of 21 books. Last week, I asked him if any of his books had failed and he told me one…

-

Economics

Economics is a social science that studies the production, distribution and consumption of goods and services. A huge portion of the foundation of what we call economics today was laid down by the British of the 18th and 19th centuries. Yes, the very same people who went plundering half the world. The very same people…

-

Man’s Seach for Meaning

This is a book by Viktor E Frank, who is a psychologist from Vienna. He gets caught by the Nazis and sent to the concentration camps. He describes in detail his experiences at the camp. As a psychologist, he got to watch the way in which the thinking of people around him changed as they…

-

Mistakes

When you undertake to solve a question in algebra. Once you solve it, you will spend some time checking the steps to make sure that you have not made any mistakes in the solution. Irrespective of how good you are at mathematics, there is always a possibility that you could have made a mistake. To…

-

Human Rationality

In mathematics, the transitive law states: x>y and y>z then it implies x>z The trouble with humans is that when it comes to making choices, they are not transitive at all! If you prefer coffee over tea and you prefer tea over hot chocolate does not imply that you would prefer coffee over hot chocolate.…